Payment Declined Email Examples

Transactional emails to help reduce churn and bring back customers to complete their order.

Explore all 48 payment declined emails

Sign-up for MailCharts to discover payment declined campaigns and get inspired!

Pro tip: Scroll down for hand-picked emails.

Declined payment emails or dunning emails are automated messages that get sent whenever a customer’s payment fails. These emails serve to notify customers about failed payments and urge them to update their billing information.

As such, failed payment emails are transactional emails. They’re account notifications and not intended to market products. That means you can send declined payment emails to those who have opted out of marketing sends.

Failed payment emails are particularly popular among subscription companies as oftentimes, customers’ credit cards change or expire, leading to involuntary churn. An effective dunning email urgess the customer to take action and update their billing information so they can keep their subscription active.

But also for one-time purchases it’s important to let customers know about a failed charge so you can recuperate what would otherwise be lost revenue and they get a new chance the purchase the item they want.

View Payment Declined Email Examples and Strategies

- 1 Create a hassle-free experience

- 2 Highlight contact information

- 3 Provide step-by-step instructions

- 4 Give them a deadline

- 5 Send more than one email

- 6 Dynamically pull in the canceled products

- 7 Set reply-to to the customer service team

- 8 Leverage the subject line to communicate the issue

- 9 Notify them of a new attempt to charge

- 10 Make a not-so-fun email, fun

- 11 Let them know what could have gone wrong

How to Create Payment Declined Email Campaigns

Want to explore payment declined emails?

Sign-up for MailCharts to discover payment declined campaigns and get inspired!

Payment Declined Email Examples and Strategies

We know dunning emails lack the pizzaz of the typical marketing emails we are used to, but they do serve an important purpose in decreasing churn! Let’s dive into a few payment declined strategies:

Create a hassle-free experience

If you’re asking a customer to update their information, clearly call out and link users to their account settings page. Take subscription boxes brand Boxycharm, for example. They call out their account page in the text as well as a clear button to update information. By linking to the account page, customers can easily click, sign-in, and update without much hassle. The easier the process, the more likely you are to reduce churn.

Boxycharm urges the customer to take action with their warning subject line. Within the email, the brand immediately lets the customer know their payment failed, and it includes a link to their subscription to make sure the customer knows what this is about. It then asks the customer to update their payment details and adds a sense of urgency by saying that boxes are limited. Lastly, the clear pink cta button leads directly to the customer’s account where they can update their billing info.

Sign up free for 48 curated examples

Highlight contact information

Look, no one wants to receive a “credit card declined” email, especially if their bank information hasn’t changed. Instead of suggesting there’s something wrong on the customer’s end, Sephora says it was unable to confirm the payment information. It also reassures the customer that they won’t be charged for the order and offers them the opportunity to get in touch with its customer support team to resolve the billing issue.

Most failed payments aren’t due to customers not being willing to pay, so be gentle when notifying them about a failed payment and make it easy for them the chance to both update their payment method and salvage their purchase.

Sign up free for 48 curated examples

Provide step-by-step instructions

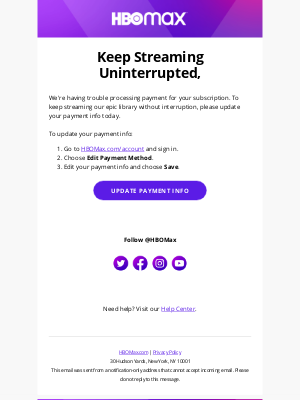

When wanting to create a seamless experience, brands can include easy step-by-step instructions on how to update payment information like HBO Max does with this payment declined email. Its easy 3-step process is extremely simple and gives customers an idea of how easy and quickly they can update their information before clicking to do so. On top of that, the brand explains why customers should update their billing information: to “keep streaming uninterrupted” and avoid account suspension.

All of this in combination with the clear CTA “update payment info” is sure to increase retention for the streaming service.

Sign up free for 48 curated examples

Give them a deadline

If items are on hold for a certain period or your brand has a grace period for declined payments, call out any payment update deadlines in the email. Purple Carrot does a great job of this within their declined payment email by bolding the text mentioning the deadline cutoff for updates.

Also here, the call to action is impossible to miss.

Sign up free for 48 curated examples

Send more than one email

Some brands, particularly subscription services, highlight deadlines over several emails to create urgency. For example, BarkBox sends two dunning emails, one a few days before the deadline and one as the deadline approaches to ensure customers update their info and their subscription payment can be processed in time to send them their monthly subscription box.

The brand also provides a link to its customer support in case customers have additional questions.

Sign up free for 48 curated examples

Dynamically pull in the canceled products

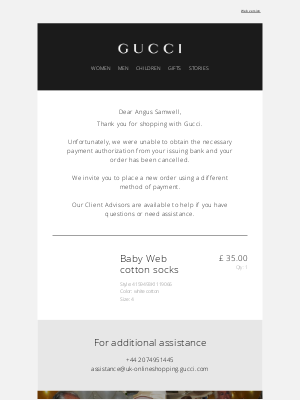

If a one-time purchase is canceled due to a payment failure, highlight the canceled item by automatically adding it to the email. In this case, your email can follow a layout similar to that of an order confirmation email but instead of confirming the order, you now inform customers of the payment failure. That’s what Gucci does here.

The brand also informs the customer as to why it wasn’t able to receive payment and invites them to place a new order using another payment method. This is the type of messaging you can use when a customer’s bank lets you know the customer is trying to pay with an account that has insufficient funds, for example.

Sign up free for 48 curated examples

Set reply-to to the customer service team

To provide a better customer experience, set your reply-to for this email (as well as a majority of your transactional emails) to the customer service email address so customers can easily respond and communicate with your team.

SSense automatically opens a support ticket whenever there’s a payment failure and lets customers know they can respond directly to the email with any questions.

Leverage the subject line to communicate the issue

Make your payment declined email subject lines stand out in the customer’s inbox by having them clearly address the issue. Vitamin Shoppe does this well with the subject line “There was a problem with your payment”. Applying this strategy allows the customer to be aware of the issue even before opening the email and also creates a bit of urgency.

Sign up free for 48 curated examples

Notify them of a new attempt to charge

Sometimes, a failed payment is due to a technical hiccup and so you may want to try to make the charge one more time. If so, let customers know. That’s what Blue Apron does with this email. The brand alerts the customer of the declined payment and asks them to please update their payment details as soon as possible if needed, as Blue Apron will attempt to charge them again.

This is another strategy to prevent involuntary churn and recover lost revenue, especially for subscription services.

Sign up free for 48 curated examples

Make a not-so-fun email, fun

Daily Harvest does an excellent job of including some humor within their payment declined email: “Your stored card is too cool for us”. This fun and humorous approach to the email stands out from the others as most payment declined emails are basic notifications with limited branding.

We also like the step-by-step instructions telling customers how they can update their information, the highlighted note giving them a deadline, and the direct link to their account page presented as a clear call to action button.

Sign up free for 48 curated examples

Let them know what could have gone wrong

Most customers don’t instantly know why a payment failed and so MunchPak shares a few of the most common reasons. Expired credit cards are not uncommon, especially when someone has been a customer for a while, but also fraud and other issues could have caused a recent payment to get canceled.

Below these explanations, MunchPak shares that the customer can update their information or get in touch with its support team.

Sign up free for 48 curated examples

Want to explore payment declined emails?

Sign-up for MailCharts to discover payment declined campaigns and get inspired!

Payment Declined Email Strategies

While these emails are simple and short, here are a few pointers and considerations when updating within your ESP (email service provider) or ecommerce platform:

Mark them as transactional emails

Regardless of your ESP, you’ll want to ensure your payment declined emails are flagged as transactional emails so that no matter the customer’s email preferences, they’re receiving these account critical emails.

Trigger based on a failed payment event

Ensure with your payment processing, you have an event set up to talk to your ESP in the case that there is a failed payment. You’ll want these emails to be triggered off that event as soon as an attempted charge is made. This email notification is something you may be able to set up in your ecommerce platform too.

Test, test, test

Due to the dynamic nature of many payment declined emails, test your new notifications with test orders to ensure notifications are populated appropriately with the correct order number, items, and any payment deadlines.

Want to explore payment declined emails?

Sign-up for MailCharts to discover payment declined campaigns and get inspired!