| |

| Here’s your daily business briefing. - 🛒 Walmart adds pre-owned goods

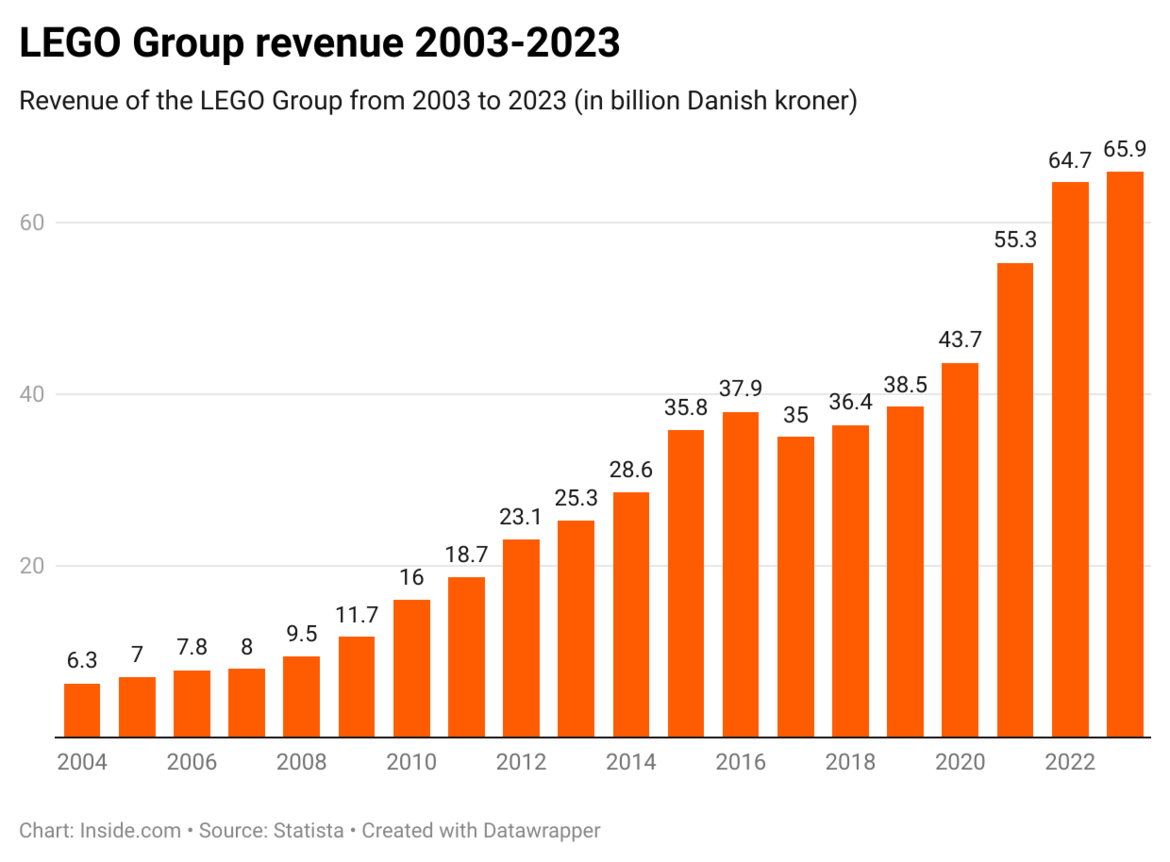

- 🧱 Deep Dive: Lego revenue up 13% in H1 2024

- 💊 Eli Lilly debuts cheaper Zepbound

Thanks for reading! Shriram

p/Shriram | |

| 1 | | Walmart is expanding its online marketplace to include pre-owned watches, collectible trading cards, and high-end beauty products, aiming to compete with Amazon and eBay. This move supports Walmart's strategy to boost e-commerce and attract more customers, contributing to a 22% increase in U.S. online sales last quarter. More: - Walmart's marketplace sales have risen over 30% for four straight quarters, with pet products and beauty categories growing annually by 20% to 30%.

- Walmart’s marketplace has introduced new brands like Cartier and Michael Kors, with Michael Kors handbags becoming top sellers last holiday season.

- Walmart plans to enhance seller verification as demand for sustainable, cost-effective refurbished electronics grows.

- Walmart's fulfillment services are expanding to handle shipping from Asia to the U.S. and now support orders from other websites.

- At a San Francisco summit, Walmart is highlighting its e-commerce growth and innovation, promoting recent marketplace developments.

|     | |

| 2 | | Lego's revenue surged 13% in the first half of 2024, reaching 31 billion Danish kroner (about $4.65B), fueled by strong sales across its product lines, including Lego Icons, Lego Creator, and its Epic Games' Fortnite partnership. This growth contrasts with declines in net sales for competitors Mattel and Hasbro, which saw drops of 1% and 21%, respectively. More: - Lego's sales in China are flat due to reduced consumer spending on big-ticket items, but the company remains optimistic about the region's long-term potential.

- Lego is expanding in China, with 20 of its 40 new stores in Q1 and 20 of 60 planned openings in the second half of 2024.

- Lego is enhancing sustainability by nearly doubling its use of renewable and recyclable materials in bricks compared to 2023.

- Lego plans to source 50% of its raw materials from sustainable sources within the next few years.

- CEO Niels Christiansen stated that Lego will absorb the higher cost of sustainable materials rather than pass it on to consumers, aiming to encourage suppliers to increase production.

|     | |

| A message from our sponsor, OUR SPONSOR. |  | | Gain a competitive advantage using innovation as a growth strategy. - Where you decide to grow your business is one of your most important decisions. You must balance factors like how fast to grow, how much to invest in growth, how to make your dollars stretch farther, and how to hedge against risk.

- Environments that have been set to catalyze innovation embrace those factors and are intentional about layering in creativity, competitiveness, and the celebration of novel ideas. In Ohio, innovation is more accessible to all.

- Diverse regions host rich talent pools of forward-thinking individuals and world-class research institutions – purpose-built by JobsOhio so you can use innovation as a tool for growth.

Learn How | |

|

| 3 | | Eli Lilly launched a cheaper vial version of its weight-loss drug Zepbound, priced at $399 and $549 for a four-week supply, about half the cost of the original pen. The vials require patients to buy syringes, easing production bottlenecks that have led to shortages, with Zepbound and Novo Nordisk's Wegovy on the FDA's shortages list. More: - Eli Lilly's move aims to boost supply and make Zepbound more accessible, especially for uninsured or out-of-pocket patients.

- The new Zepbound vials will be available via LillyDirect at $399 for 2.5 mg and $549 for 5 mg, compared to $1,060 for the injection pens.

- The weight-loss drug market is expected to hit $130B in annual sales as Eli Lilly and Novo Nordisk compete to meet rising demand.

- Eli Lilly raised its revenue forecast on strong Zepbound and Mounjaro sales, while Novo Nordisk cut its profit outlook due to supply issues with Ozempic and Wegovy.

- Eli Lilly and Novo Nordisk face competition from cheaper copycat drugs and have filed lawsuits to block compounded versions of their medications.

|     | |

| 4 | | The number of crypto millionaires surged by 95% in the past year, reaching 172,300, with pure bitcoin millionaires more than doubling to 85,400. Additionally, there are 325 crypto centi-millionaires (those with $100M or more in crypto holdings) and 28 crypto billionaires. More: - Since its January launch, Bitcoin ETFs have quickly amassed over $50B in assets, attracting substantial institutional investment.

- Bitcoin's price rose 45% this year to around $64,000, helping boost the total crypto market cap to $2.3T from $1.2T last year.

- Six new crypto billionaires emerged in the past year, with five of them crediting their wealth to bitcoin.

- Changpeng Zhao, founder of Binance, is the richest crypto billionaire with an estimated $33B, having increased his wealth by over $10.5B in the past year.

- Many newly wealthy individuals are moving to tax and crypto-friendly regions, with Singapore, Hong Kong, the UAE, and the U.S. at the forefront of favorable crypto regulations.

|     | |

| 5 | | U.S. home prices hit a record high in June 2024, rising 5.4% YoY on the S&P CoreLogic Case-Shiller Index. New York saw the largest gain at 9%, while Portland had the smallest at 0.8%. More: - The 10-city composite rose 7.4% annually, and the 20-city composite increased 6.5%, slightly below last month's figures.

- With the National Index averaging 2.8% higher than the Consumer Price Index, the difference between the growth of property prices and inflation is greater than it has historically been.

- Lower-tier homes in cities like Atlanta and New York have surged faster than higher-tier homes, with New York's lower tier rising nearly 20% above the market in five years.

- Despite mortgage rates peaking at 7.5% in June, home prices rose, defying the usual cooling effect.

- Home prices are expected to ease month-to-month this fall due to seasonal factors and increased inventory but will likely stay above last fall's levels.

|     | |

| 6 | | In October 2023, nearly 40% of U.S. adults used credit cards or loans to manage rising prices, up from 37% a year earlier, according to a Federal Reserve Bank of Boston report. Gen Z and millennials, particularly those with some college education or earning between $35,000 and $75,000, are most likely to turn to credit in response to inflation, with 34% of adults in job-loss households also using these financial tools. More: - Consumer prices rose 2.9% over the 12 months ending in July 2024, the smallest annual increase since April 2021.

- Rising prices continue to affect low-income households and recent job losers, despite easing inflation.

- Consumers are cutting back on dining out, canceling subscriptions, buying less fresh produce and meat, opting for generic brands, and postponing major purchases.

- Credit card debt rose to over $1.14T in Q2 2024, up from $1.03T a year earlier.

|     | |

| |

| Upcoming Events | * This is a sponsored event | | | |

| Freelance Writer | | Shriram is pursuing Master’s in Business with Marketing at Warwick Business School. He worked as a Senior Consultant in Tech and Political Consultancies before his Masters. He is passionate about Tech, Marketing, Strategy, Anthropology and Politics. He is also the Postgraduate Ambassador for Warwick Business School. | | This newsletter was edited by Shriram Jeevakumar | |

| |

|  JobsOhio exists to help companies and their people thrive and make Ohio your competitive advantage. | |

|

| |